3 Ways To Boost Your Sales Using Loss Aversion (AKA FOMO)

Whilst I’m big on the power of mindset, sometimes you need more than a hunch.

So luckily, back in 1992, Eldad Yechiam carried out a study, which showed we value losses 2.3 times more than gains of the same value.

Basically, losses hurt us wayyyy more than wins make us feel good.

So how can we, as marketers, leverage that knowledge to boost sales?

By looking at other businesses that are doing just that, and implementing similar ideas in our own businesses… obviously!

Get Specific

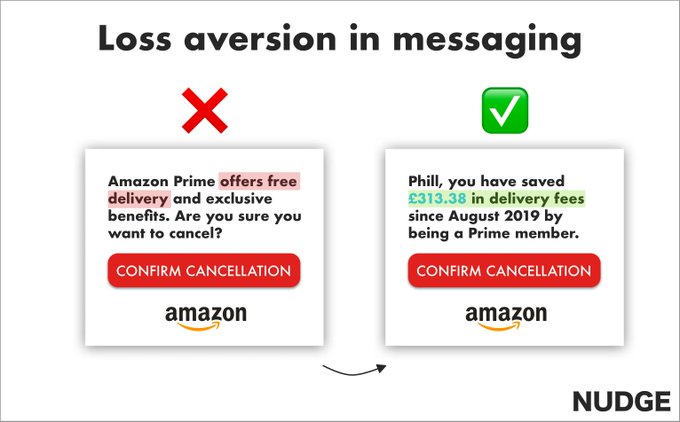

If you’ve ever tried to cancel Amazon Prime, you would have come face-to-face with a great example of loss aversion copywriting.

By changing from a generic message to a personalised calculation of what you’ve saved so far, it makes you scared of no longer saving it in the future.

It quietly implies, that if you cancel Prime you could easily lose a lot more money than the small cost of your Prime subscription. Which in turn leads to a higher customer retention rate for Amazon.

Image via @p_agnew (Twitter)

Savings First

Amazon also uses loss aversion psychology in their online shopping listings.

If you ever search for a book, for example, you’ll often see a listing like this – and chances are your eyes will automatically be drawn not to the price, like in conventional shops, but rather to the larger, red saving you could make.

On an unconscious level, most people will then want to buy the item, whilst it’s on sale instead of waiting and possibly ‘losing money’ when the item is no longer discounted and it’s back to its original price.

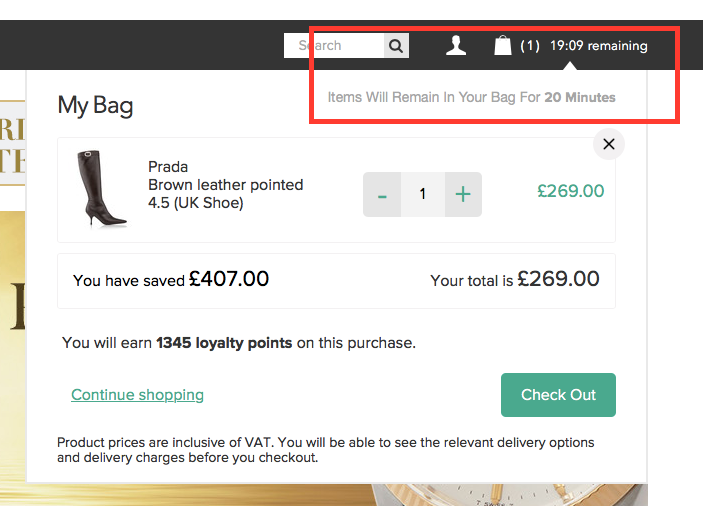

Another tactic you could consider is one used by some e-commerce sites.

Its easy to add an element of urgency, by using a countdown timer to ensure customers act fast (e.g without having time to reconsider or talk themselves out of it)

It gives the sense that if you don’t act now, you will likely lose out – loss aversion marketing at its simplest

Consider Cashless

If you have a physical premises, it’s worth trying to steer customers away from using cold hard cash, by promoting alternative methods such as cards or apple pay.

This is because handing over cash heightens our sense of loss in a way tapping a card doesn’t.

In fact, cash heightens our feelings of loss so much that a 2201 study found that shoppers spend up to 100% more when using cards instead of cash.

I mention this one because its important to remember, marketing extends way beyond the sexy digital side of it – and every interaction a customer has with your brand, whether online, over the phone or in person counts.

Plus, a sale’s a sale at the end of the day isn’t it?

I’ve seen those techniques used by many. Fear of missing out, urgency and scarcity. Because as humans we are lazy and we tend to delay things (procrastinate). So it’s necessary to give them any reason for taking action RIGHT now.